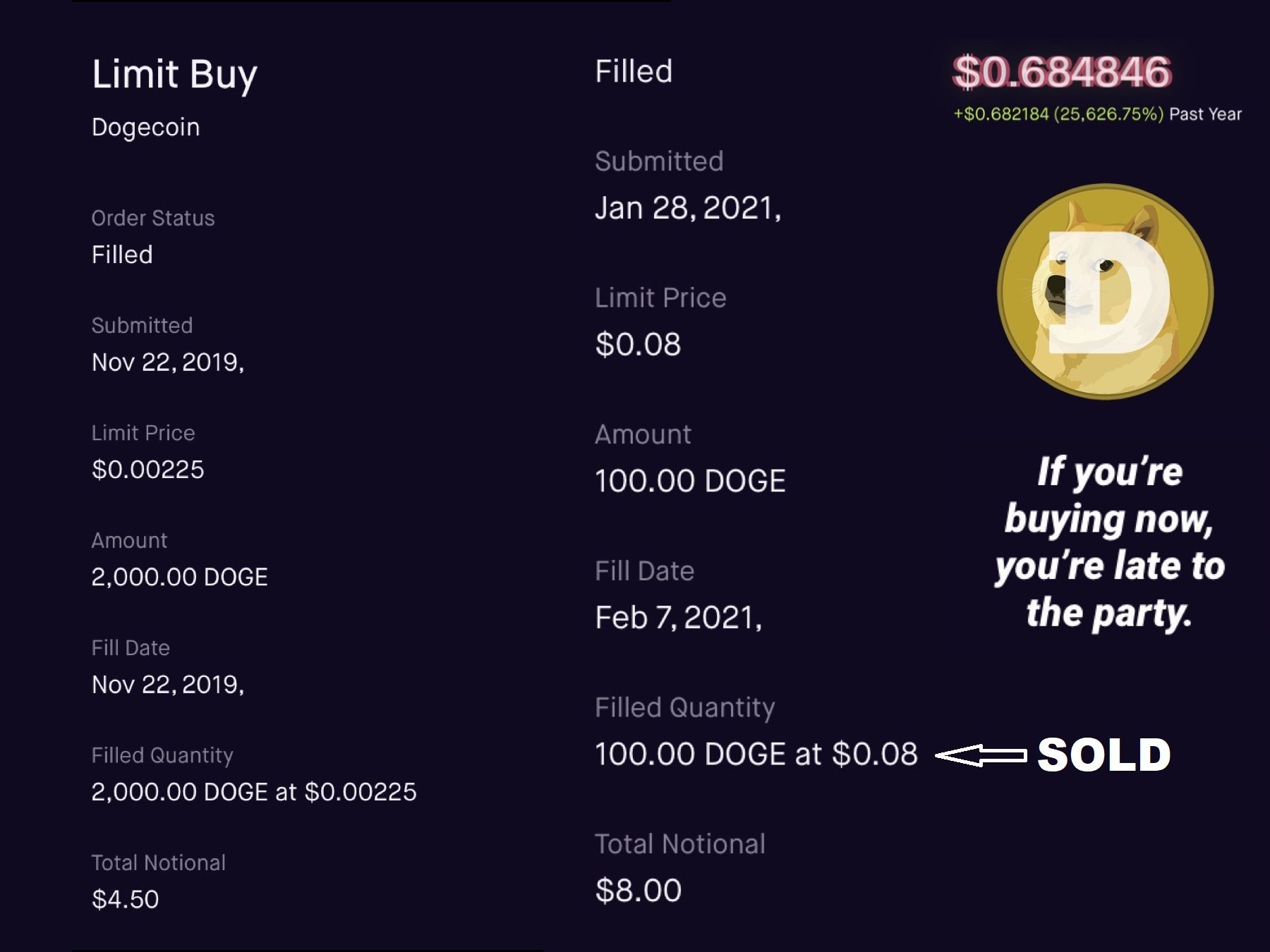

First, realize that this is not financial advice. Everyone has probably heard about Elon tweeting about Doge, being accepted on BitPay and Robinhood, or for sporting events. Based on the recent runup during this bull cycle, I currently feel that Doge is over valued from Elon and Cuban hype at $0.68. I feel that this isn't currently sustainable but definitely shows the power of the Meme. There are only a few wallets that hold a majority of the tokens and it's hard to know the potential circulating supply that could be dumped at any time. With that said, there could be a case for Doge long term or it could be just another 'shit-coin' without adoption.

Bitcoin is seen as a reserve asset almost like a digital gold but better, mostly adopted by generation X/Y who were around at it's start. Yet in a world with a fractional reserve system, it's not likely that Bitcoin will be seen as a currency or a commonplace medium of exchange any time soon due to it's strong deflationary nature. It simply works better as a store of value for the time being against fiat.

We recently printed over 30% of the total money supply in one year which should result in a huge inflationary event over time. With each crisis, the amount of stimulus or increase to supply should exceed the prior event in order to have any impact in our debt based system.

Currently there are 130 billion pennies in circulation which is a big number. It's pretty common knowledge that it takes about $0.015 to $0.02 to produce each penny. There is about 5-16 billion pennies produced each year from Mints. Now consider that Doge has 129 billion coins in circulation with a 5 billion minted each year which is about equal to that of pennies. Doge currently has a diminishing inflation rate of about 3.94% which isn't bad. Based on this, I could justify Doge being worth $0.01 to $0.03 when compared to pennies as they both have a similar inflation but realize that Doge has no metal value and was previously under $0.01. Real pennies have been debased over time as the copper in pennies is substituted with things like Zinc yet you can't really debase a crypto currency. As currency continues to be debased from an increase in supply and through inferior substitutes, it should lose value against an asset which is unchanging with a trackable and set inflation; assuming nothing changes in the code base going forward.

The next factor is population demographics. Consider GDP and the stock market growth through 1980-2000 which was primarily driven by Boomers through their spending years as they historically have been one of the largest US population demographics in terms of size. This generation and prior bought Gold, Real Estate, Bonds, and Stocks. Generation X&Y who grew up in a technocracy, witnessed a dot com bust and the aftermath of prior generations getting taken advantage of from market and debt cycles. X&Y's were the one's to largely adopt Bitcoin and other cryptocurrencies. They lack trust in the financial instruments of prior generations and quite frankly feel like they missed out on many opportunities. The debt system inflates prices allowing only those who are credit worthy to enter.

Millennials and Zillennials are in the same boat feeling that they missed out on the opportunities such as Bitcoin. The younger generations have an advantage with the progress of the internet, availability of investing information, and ease of use with apps like Robinhood. Just like their peers before them they gravitate to new affordable assets such as Ethereum or Doge. Who ever listens to prior generations? It's hard to achieve similar gains to those that got in early. The key factor to take into consideration is that Millennials and Zillennials will out pace Boomers in terms of population demographics whereas generation X&Y will have little impact.

Now the kicker. Realize that Bitcoin has a fixed supply. In order to have Bitcoin's total market cap continually go up in value, dollars have to pour into it as an asset class. In order for Doge to gain value and increase it's total market cap, it just needs to maintain or grow in use beyond it's 5 billion increase to supply. If this happens regularly over time, it could be hypothetical that one day Doge could reach a $1 trillion market cap or greater. Which gives a long term use case with adoption.

Will Doge make mainstream adoption and maintain value? Only time will tell.

Disclosure Statement: This is just my observation and findings. This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained here constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments whatsoever by the author, presenter, or other associated parties for the content being provided. Crypto is a speculative and high risk investment with potential for complete loss. Regulation of crypto is currently undetermined and often changing. Past performance is no guarantee of future results. In full disclosure, I do own a small amount of Doge as speculation.

Source: