As they say, it’s the journey and not the destination. This phrase is well suited to crypto, being that most won’t even fathom what’s to come.

Life experience obviously affects our decisions. My father, a coin collector, had retired to Mexico. Because of this, he deposited a considerable portion of his collection into a safety deposit box with the bank. In 2013 the bank underwent a remodel and requested that safety deposit boxes be withdrawn. Since they were out of the states, a family member had to pick up the contents of the box. Naïve regarding coins or contents and trusting the bank, they hadn't check or realized that the contents had been swapped out for loose change until months later upon my parents return. A little late to make a complaint but an event that I'll never forget. Echoes of the 1934 gold seizer. Had this been a cold wallet, the funds would still be there.

My journey in crypto starts back in 2013 when a friend gifted me $1 worth of Bitcoin when it was valued at about $23.80. He then gifted me another $1 of Bitcoin again in 2016 when it was worth $420. I can't say that I was smart enough to catch on but I held. I had an early background in computers and programming. I attempted to mine Bitcoin on a PC but quickly gave up due to the blockchain size (1 Gig) and slow internet connection. It didn’t seem worth it at the time and my focus was stocks. All good things take work and I applaud those that paved the way.

Of course I kept a small position. I remember the days of the early fork of Bitcoin Cash. My friend and I were uncertain what would happen to Bitcoin and thus traded into Ethereum to avoid risk not realizing that those holding Bitcoin would also receive Bitcoin Cash. I remember the early days of buying ETH with a credit card to only watch the price then drop. The interest charges reminding you monthly.

I was all about dividend stocks and avoiding risk. I watched as Bitcoin rose and then fell repeatedly, still being skeptical. During this same time period I also watched companies declare bankruptcy, wipe out my shares only to re-open with new shares issued to debtors. Crypto had it’s ICO issues as well which I mostly avoided.

Poor means, “Passing Over Opportunities Repeatedly”.

When a discount brokerage added crypto to their platform, I started buying small amounts of BTC and ETH as a portfolio hedge; only later would I realize the issues with the platform, not being able to transfer crypto out. “Not your keys, not your crypto”.

At one time, I thought about using an equity line to purchase Bitcoin at $3K after the crash from $19K but I’ve always been pretty risk adverse. There was always the fear it could fall to zero. Shortly after that when it ran up to $13K, I had one friend that bought $1,000 dollars worth of Bitcoin during lunch and five minutes later after lunch he was down $100. I believe like many, he finally gave up and eventually just sold out at a loss. Buffet’s #1 rule, “Don’t lose money” and rule #2, “Don’t forget rule #1”. If your HODLing in crypto, your bound to lose money at some point. When you lose money in crypto, most claim that it’s “really about the technology”.

As an economics major, I’m a fan of both Ray Dalio and Raoul Pal, both of which were talking about US debt concerns throughout 2019. I was enjoying the ups and downs of the market associated with Trump Twitter feeds. I realized the issues ahead of us and slowly started to acquire Bitcoin as a hedge against the the dollar.

I eventually logged into my old GDAX account which was now Coinbase Pro seeing the small bit of ETH that I had acquired from long ago. My friend had been doing micro-loans and experimenting with various new projects which would become known as DeFi or Decentralized Finance. With banks paying virtually nothing in interest, I felt it was time to start diving in and educating myself.

My friend suggested that I play and experiment with ETH. I created a simple CryptoKitty with my kids and noted the necessity of ETH for gas. I quickly realized the importance of ETH. I started analyzing the various tokens and their use cases such as for staking, protocol, governance, versus just being a currency. I even bought a little bit of virtual real estate for advertising. I was interested in the possibility of blockchain technology for real world applications and felt virtual real estate provided a great use case. Later I'd find out that people were already starting to tokenize actual real estate.

Like any investment, one should have a plan or goals. I came up with the 1 of 1 million strategy. In 2019, there was approx. 18.9 million millionaires thus being 1 of 1 million seemed pretty significant. If I could work towards being 1 of 1 million, that seemed like a lofty long term goal. I’ll admit I probably bought a number of speculative coins at first which tended to be cheaper. Depending on the project, there is definitely some great opportunity.

Wanting more knowledge, I joined Sacramento’s CapCity BTC MeetUp Group. Timing is often crucial and I began following the moving averages of BTC and ETH. With word of Bitcoin’s halvening just a few months away crypto was seeing a run up in January and February. I had just learned that it would take 32 ETH to stake and made that a priority. Then Bitcoin’s started to act weird, golden crosses weren’t performing as expected. The next week the stock and crypto market took a huge drop. COVID was for real and the world was coming to a halt.

Little did I know, I’d quickly become part of the groups leadership team of CapCity BTC as I thrusted myself into DeFi. COVID has actually become a blessing to the crypto space as it has united people all over the world through platforms such as Zoom and Discord. The amount of information out there has increased substantially and the ability to participate in crypto keeps getting easier.

While people were distracted with COVID, the government broke the leveler on the printing press and start supplying trillions of dollars into the market justifying an even greater case for crypto. In a time when we need more transparency such as on-chain transactions, there are talks of reducing the requirement for 13F reports by large institutions and removal of the Volkerner rule.

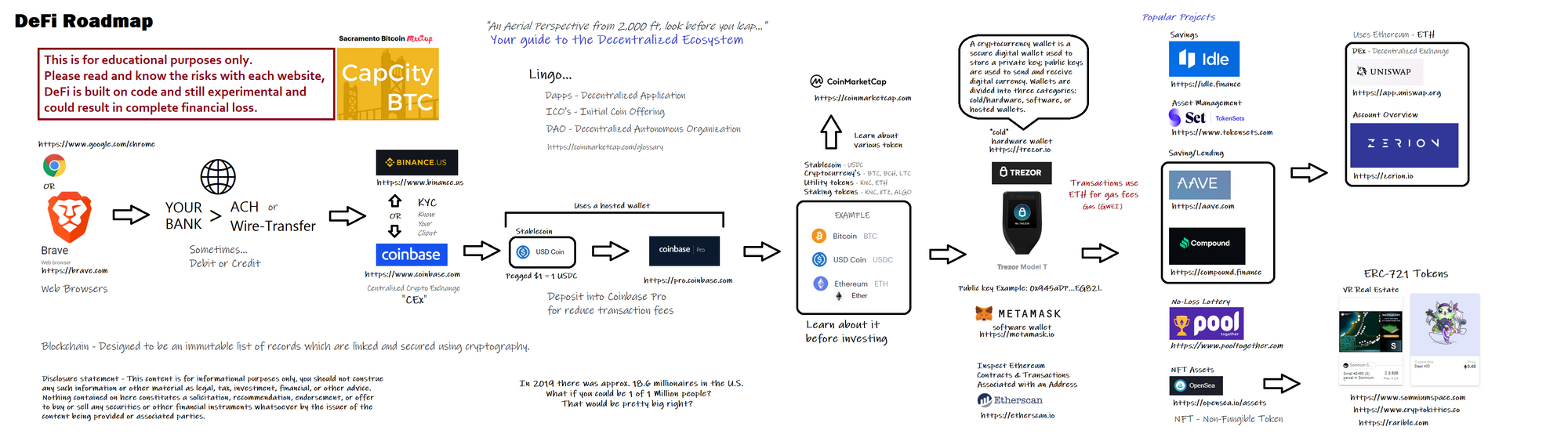

There is so much to learn in this space, things like yield farming and because of this, I’ve created a simple DeFi Roadmap to aide others in the process of learning. Please note that crypto and DeFi is not without risk and can result in financial loss. This content is for informational and educational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on here constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments whatsoever.

This is merely my journey in the world of crypto.

Join CapCity BTC and start your journey in crypto today. https://www.meetup.com/Sacramento-Bitcoin-Meetup https://www.linkedin.com/groups/13875913/ https://www.facebook.com/CapCityBTC https://www.youtube.com/channel/UC2r2QcNUHFPm13iedZ8JJtQ