When most people think about cryptocurrency, they often view it through the lens of stocks and investment. For many, cryptocurrency is seen as a speculative venture, involving the purchase of tokens on centralized exchanges with the hope that their value will rise, allowing users to convert them into traditional currency, like dollars which those in crypto refer to as fiat. However, for those who actively use cryptocurrencies, it represents something entirely different.

Cryptocurrencies such as Ethereum (ETH) serve as a means to process transactions and engage with smart contracts. This concept may appear unfamiliar to many, so let's use the example of someone using ETH on the Ethereum blockchain to shed light on how it all works.

In the realm of decentralized finance (DeFi), the process typically begins with the user withdrawing their crypto to a secure storage method, like a hardware wallet. Think of this wallet as your car, which allows you to navigate the vast world of decentralized finance, with Ethereum blockchain serving as the main highway. Just like a car requires fuel, you'll need a bit of ETH to get where you want to go and back, with a little extra for stops along the way. In the crypto world, ETH is often referred to as "gas," and its quantity usage is usually measured in Gwei. The stops along the way via various websites are known as decentralized applications, or DApps, which frequently interact with smart contracts. Smart contracts are like programs written on a blockchain that enable various functions, including gaming, lending, facilitating trades, and many other applications. Preferably, it should be a public and audited smart contract.

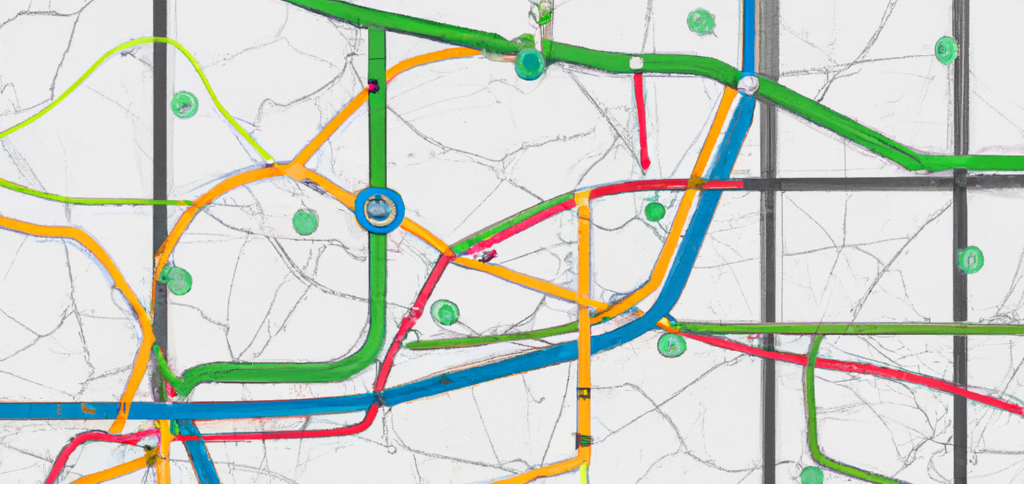

Occasionally, this Ethereum highway might experience congestion due to high user activity, much like traffic during rush hours. At such times, users may turn to second-layer solutions like Arbitrum or Optimism, which act as alternative routes to alleviate traffic, though not all DApps will be accessible through these routes.

While ETH is the primary fuel (gas) for this journey, it's not the sole option. USDC, a stablecoin backed by dollars or US Treasuries and issued by Circle, can also be utilized on the network for payments and other purposes along with other tokens. Some individuals prefer to hold barrels of oil, while others favor wallets filled with ETH. However, both should ideally be protected against price volatility in their commodity of choice. This is where decentralized exchanges (DExs) like Uniswap come into play. Users can deposit a portion of their ETH and USDC to create a liquidity pool, facilitating trading through this pool. The trading process from other users rebalances the pool and, in return, provides fees to the depositors in the form of underlying assets. Those in crypto are often comfortable with receiving stablecoins or more crypto. In this liquidity pool, if ETH's value surges, it will automatically convert into more USDC, and if ETH's value decreases, the USDC will convert into more ETH. This process effectively stabilizes the overall value of the assets in the pool. It's essential to note that this approach may not yield the speculative gains that holding ETH alone might offer, which is what crypto enthusiasts refer to as "impermanent loss." It's a fascinating technology that holds great potential for traditional financial markets.

In summary, cryptocurrency and blockchain technology offer a unique and complex ecosystem, with real-world applications that extend beyond mere investment. Understanding the different roles of cryptocurrencies like ETH and stablecoins like USDC, as well as their use in DeFi, can open the door to a new world of financial possibilities that's more than just speculation.

Disclosure Statement: This content is an opinion piece designed for discussion and educational purposes only. Readers should not interpret any information or materials provided here as legal, tax, investment, financial, or other advice. Nothing presented here constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. Conduct your own research and due diligence. Seek proper counsel. Make your own decisions based on your risk tolerance and level of knowledge, recognizing that any investment carries the potential for loss. Only invest what you can afford to lose.