I've been interested in stocks since I was a teenager and have been managing my own portfolios since the days of Scottrade. Upon the release of Robinhood, I quickly jumped on the bandwagon for free trades which helped my value averaging approach to investing in a diversified portfolio over time. What's spewed to the masses is usually counter to what large investors are usually doing as public information is often lagged. It's often a case of, "Do as I say but don't as I do"; most aren't financially literate enough to take advantage of market opportunities. People like Raoul Pal of Real Vision Finance are trying to change this.

Tip #1: Start early and educate yourself on investing and finance.

I sat on the sidelines of crypto with a little bit of Bitcoin in a Robinhood account for a while, not realizing that one couldn't withdraw it. Having a friend in crypto, I was privy to the phrase, "Not your keys, not your crypto". Which meant that if you couldn't obtain your crypto through a private key, you didn't really own it. This is important for historical reasons which often get forgotten. In 1933 the US had FDR's gold confiscation which was used to bailout the Federal Reserve. Most don't realize that the money deposited into an exchange or bank is really a loan to the bank and shows up as a liability; they owe you as long as they remain solvent thus why FDIC was created. In the Cyprus financial crisis, savings were confiscated to protect the island's banking system which was known as a 'bail-in'. With a ballooning debt crisis, could we see similar events again in our future? YES.

Tip #2: Crypto can give you control over your wealth.

It was 2020 and a potentially exciting year for crypto with the coming of Bitcoin's halving. Ray Dalio was often speaking about a potential debt crisis and coined the phrase 'cash is trash' which I felt was a valid reason to own a little Bitcoin as a hedge against the dollar. I couldn't have anticipate the events that would unfold because of Covid. Being locked down would provide both time and an opportunity to learn about crypto, further study our failing inflationary debt based financial system, and be awoken to the future of finance. I decided to start the year right by transitioning my buying to Coinbase where crypto could be withdrawn for self-custody when needed. This would allow for participation in decentralized finance (DeFi).

Tip #3: Use a service that allows crypto withdraws.

Although very much aware of the space, I was still rather new. My friend was more bullish on ETH (Ethereum) vs BTC (Bitcoin). Ethereum allows for Smart Contracts to be written on the Ethereum blockchain in a language called Solidity which offers a wide range of possibilities. My friend's kids had been playing with CryptoKitties, a breeding game for generating random cartoonish cat NFTs (Non-fungible Tokens). He suggested that I buy some ETH, export it to a Metamask wallet, interact with the Smart Contract and create some CryptoKitties in order to gain a better understanding of ETH's use and purpose. I created a few various cats with my kids and realized that I had to spend the newly purchased ETH in the form of 'gas' GWEI in order to interact with the Smart Contract. Each ETH is worth one billion GWEI. Each project has different 'gas' requirements based on the complexity of the Smart Contract which you are interacting with plus a transaction fee. Early in the year, transactions or 'gas' fees were about $3 dollar which wasn't that bad but costs steadily grew. It's important to watch this as the 'gas' fee can fluctuate based on the traffic on the blockchain. Those willing to pay more in 'gas' get priority and can move to the front of the line in order to have their transaction processed with priority. Many arbitrage bots were paying high 'gas' fees in order to cut in front of big transactions. If current 'gas' levels are high, insufficient 'gas' could result in a failed transaction which still incurs a minor spend of 'gas'. Like many others, CryptoKitties was my first taste of the Ethereum blockchain.

Tip #4: Monitor 'gas' and your usage.

I caught the crypto bug and found a local crypto MeetUp group called CapCityBTC in Sacramento and went to my first meeting in January. People were talking about this thing called DeFi (Decentralized Finance). At the time, I had no clue other than a few things that my friend mentioned about a MakerDAO allowing the creation of DAI via a loan of locked up ETH. I'll admit that I was clueless but fascinated. Having a real estate and economics background, I was at first interested in virtual property within the various gaming spaces such as Decentraland, Somnium Space, and Sandbox game. I could see potential marketing opportunities and applications for real estate in the future. I'd later discover that some people were already working towards the tokenization of real estate.

While in the gaming space, I met an individual via chat who was speculating on various tokens. They had been tracking whales and various projects looking for opportunity. Although staying anonymous, we continued chatting about various projects as my focus shifted from gaming into DeFi. The anonymous individual was polar opposite to my thinking which I liked. They were big on holding only one to three investments, making a big return on price movements, and then moving to the next. As he became bigger, he found this strategy harder and harder. I on the other hand began seeing a bigger picture, this DeFi could revolutionize finance and create a form of self-banking or at least be the backend of future financial applications. I joined the Discord for various projects and began building a network of contacts within crypto space through Zoom, LinkedIn, Twitter, Facebook, etc. There is so much to learn and people are often willing to share within the decentralized open source community of crypto and blockchain technology.

Tip #5: Network with others in the crypto space.

With new projects popping up almost daily, I figured that I had to come up with a system to manage my risk and avoid to much exposure to any one project. Everyone wants to be a millionaire, apparently there was 16 million millionaires in 2019 thus I figured if you could be 1 in 1 million that had to be pretty darn good goal and have some significance. So I developed my 1 in 1 million portfolio strategy approach to diversification on various alt coin projects. For example, a total supply of 10 million COMP tokens would mean working towards owning 10 COMP. I figured this would be a good basis to start from. One could accomplish this strategy with merely a few hundred dollars in various alts or a few thousand in larger cryptos such as LTC (needing only 84) or BCH (needing only 21). Bitcoin would obviously be the most expensive to gradually work towards and tokens such as ETH or XTZ (Tezos) would be hard to quantify as they are inflationary.

Tip #6: Have a strategy.

Similar to the days of investing with transaction fees, trading in DeFi can be expensive in small quantities. I bought a few small amounts of tokens in various projects and my anonymous friend pointed out that I'd have to realize a 30% gain just to break even due to the transaction fees. I've also purchased digital art which is complete speculation on future value but at least a cool way to remember the time period. Although I believe in dollar cost averaging, it could be an expensive approach in DeFi with fees. I found that the diversification strategy might be a little easier on a CEx (Centralized Exchange) or better yet in TokenSets such as DPI or those in PieDough which both offer an index of DeFi tokens.

Tip #7: Minimize trades and transaction fees.

With news of the halving the crypto market saw a good run from January to February with ETH running above $200. Then Covid happened. March of 2020 was an interesting time period. The stock market saw a plunge and the crypto market followed shortly thereafter with a DDoS attack on BitMEX which resulted in a liquidation of long positions dropping the price of Bitcoin and alt coins with it; ETH ended up sitting in the $100 range. Compared to traditional markets, the crypto market is small and sudden movements in volume whether by a liquidation, a whale, or social pumping of FUD (Fear of Uncertain Doubt) could cause dramatic movement in the price. I write this article as Bitcoin recently hit $40K and then fell back to $30K. Swings in crypto are normal and not for the faint of heart.

Tip #8: Know your risk tolerance.

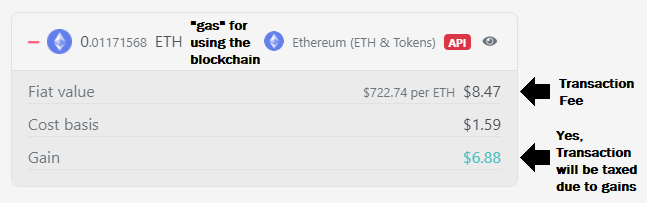

I attempted to deposit some ETH into Compound which provided an interest bearing token referred to as a cToken, which could then be borrowed against if one so desired to leverage crypto assets. Note that every exchange between tokens, even cTokens, could potentially be a tax event. Upon the withdraw of my original ETH, I also noticed that I received a step up in basis on my ETH, based on the price of ETH at the time of the withdraw. The gain realized in the step up basis would be considered a taxable event under the IRS short term gains rules. People need to remember, just like stocks, each crypto token sale resulting in a gain could lead to a potential taxable event depending on the State and the duration for which it was held. In regards to trading losses, remember that wash rules also apply. Since I was buying ETH as needed, most of it would fall under the category of short term gains. I'm now considering it the cost of tuition for learning about crypto and DeFi. I'd suggest to others that they hold for at least a year before participating in DeFi due to short term gains. Make sure to keep good records and use the time to educate yourself about the space and watch for potential legal ramifications from future regulation and taxation. Due to short term gain rules, as ETH's price increased, I'd also notice that each transaction would create a taxable event as seen in the image below. Realistically, this was money spent on a 'gas' transaction.

Tip #9: Understand your potential tax and legal implications.

It was a unique time period in DeFi when new platforms and tokens would almost popup daily. It was the year of DeFi. The DeFi market grew from $690 million to a whopping cool $16 billion of capital locked up. A day in DeFi was a week in normal financial development, a week was a month, and a month would be like a year. It made the ICO (Initial Coin Offering) days almost look like a joke. A site would spin up, airdrop or deposit some newly minted crypto as liquidity paired with ETH into Uniswap and wait for people to trade into it for funding. Some sites were legit projects but many were scams or just testing theories to see if they worked. Many were pumping and dumping while speculation ran rampant in the space. Some projects would be launched prematurely by those impatiently waiting to get in while others are still in development. To avoid being seen as an SEC violation, many tokens opted to be a decentralized form of ownership as Governance tokens. Some sites would knowingly ban US users to avoid compliance issues as the US has been slow to adapt in a form of protectionism. One would scour Discord channels, White Papers, social groups, YouTube, and Twitter feeds for information on the latest project.

Tip #10: Do your research and due diligence.

Being that the total market cap of the crypto space was small, large institutions gave it little attention. The potential was great. It was like opening venture capital up to the masses and giving opportunity to the little guy. As with any investment, one also incurs risk. Projects would launch, some tested, while others weren't, and some where just roadmaps. If it ended up as a solid project with good utility, one could potentially see returns of 300% in just a few months while others would slowly fall to zero. I met foreigners looking to get dollar exposure within DeFi through various stable coins which are pegged to the dollar. The possibility of high yield would drive capital inflows as banks provided less than 1%. Yield farming popped up providing 1,000% returns in the platform's native token which often fell as people sold off. Some did well after a few hiccups like Sushi but others continued to see their token price erode in this gamification of finance which we called 'money legos' via stacking protocols. It really showed the impacts of an inflationary currency like the dollar but in a shorter time frame. Many would sell out for ETH which was seen as the superior asset. Long term though, many of these tokens would have fixed quantities which would deplete over the next few years.

Tip #11: Invest in measurable assets to avoid inflation.

One mistake that I made was jumping into a project being forked by a kid and two others. They had forked a project called CORE which did fairly well and I hoped the fork would net similar results. Their version failed in the execution and follow through when the three originators start arguing. It's always important to have a solid team supporting a project. Luckily the project was eventually picked up and merged into CORE. When speculating, you realize that some investments will be a complete loss.

Tip #12: Don't invest what your not willing to lose.

If a smart contract's code wasn't solid or tested, a hacker would usually find the exploit and withdraw funds which happened a few times with honey pots often exceeding a million dollars in value. I invested in a platform called Pickle which was hacked. I had deposited DAI into Pickle for 8% APY return. I could then stake the pDAI into a Jar and receive a total of 20% APY. Something then was changed which allowed for an exploit and a hacker withdrew almost all of the DAI from the Pickle contract. The funny part was, I had thought about withdrawing the week before but didn't want to pay a $20 transaction fee due to 'gas' prices which would have been cheaper. When I finally attempted to withdraw after the hack, I got back $0.10. It's one thing to lose money on a bad investment, it's another feeling to have it stolen from you. Everyone likely has a similar story in crypto.

Luckily my diversification minimized the overall loss.

Tip #13: Don't put all your eggs into one risk basket.

To me the DeFi space seemed like an ingenious way to develop and test a new financial system at a lightning speed. I would probably be giving governments to much credit although I have to believe that they are forward thinking at least a few decades ahead. With people like Brian Brooks as Comptroller of Currency, somehow, I believe this to be part of an overall plan. I anticipate a lot more regulation in the near future but see a future where privacy is gone, Bitcoin is a reserve asset, while every transaction is monitored and taxed. Privacy really should be encouraged. Everything is open and transparent on the blockchain, I could look at a whale wallet, someone with over one million in total value, and see what they were holding and look at current and past transaction for investment ideas. I could see FinCEN and the SEC wanting to step in on regulation with regards to KYC (Know Your Client) and AML (Anti-Money Laundering) but this will be difficult as it's decentralized. It's more likely that countries will penalize their own citizens through regulation vs allowing people to be free from the economic slavery which we have been accustomed to. Like Bitcoin, the movement will be hard to stop as it's a global effort.

Tip #14: DeFi is a global financial platform.

It felt like a one in a life time opportunity to get into something so pivotal that it will change the future forever. With the recent run up in ETH's 'gas' price, taxable short term gains, and potential regulations, I'm pivoting my focus and taking more of a back seat to see how the space continues forward over 2021. I anticipate and look forward to DeFi's growth and adoption in the years ahead especially with the coming of ETH2.0 and it's potential DeFi competitors Cardano, Polkadot, and Tezos. It was a good first year in DeFi and for the moment my last as I watch regulations and various blockchains catch up to solve inherent problems within the space. I anticipate that the future of decentralized finance will arrive sooner than people realize.

Tip #15: The adoption of DeFi is coming.

Disclosure Statement: This content is for informational and educational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained here constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments whatsoever by the author, presenter, or other associated parties for the content being provided. The crypto space is a speculative and high risk area with the potential for complete loss. Past performance is no guarantee of future results.